4. Maintain output type

Output Type RD04 - Invoice Receipt MM is a special function, responsible for the execution of the Idoc and will be entered in the Partner Profile later on.

Output type RD04 is maintained: Img: Sales and Distribution -> Basic functions -> Output control -> Output Determination -> Output Determination Using the Condition Technique -> Maintain Output Determination for Billing Documents à Maintain Output Types (T. Code V/40).

Partner functions

![]()

Sales and Distribution -> Basic Functions -> Output Control -> Output Determination à

Output Determination Using the Condition Technique -> Maintain Output Determination

for Billing Documents.

Assign Output Types To Partner Functions

![]()

Maintain Output Determination Procedure

![]()

Assign Output Determination Procedures

![]()

Master DataMaintain output Master Data

Logistics -> Sales and Distribution -> Master Data -> Output -> (T. Code VV31)

5. Create Logical AddressImg: Sales and Distribution -> Billing à Intercompany Billing -> Automatic Posting To

Vendor Account (SAP-EDI) -> Assign vendor. (T. Code WEL1)

![]()

Logical address 1180P3100 is made of the supplying Company Code (1180) and the

receiving Customer (P3100).

Note: If the receiving Customer is a numeric number you must add zeros between the

Company code and Customer number so the Logical Address will be 14 digits.

E.g if the customer number was 3100, than the logical address would have been

11800000003100 as can be seen in the second line.

(In our case the customer is an alpha numeric number so the second line was not necessary. It was created just for this documentation and was not saved)

The Logical address is completed when the receiving Company Code and the Vendor are

entered in the detail screen.

It is also necessary to activate the account assignment.

IMG: Sales and Distribution -> Billing à Intercompany Billing -> Automatic Posting To

Vendor Account (SAP-EDI) -> Activate account assignment.

![]()

6. Creating a Partner Profile for both Customer & VendorTools à Business Communication -> IDoc Basis -> Idoc -> Partner Profile (T. Code

WE20)

![]()

Customer:Put cursor on Partner type KU and press create.

Enter typ, Agent & Lang,

SAVE

Press

![]()

in outbound paratrs. Section, to maintain detail screens

The following screen will appear.

![]()

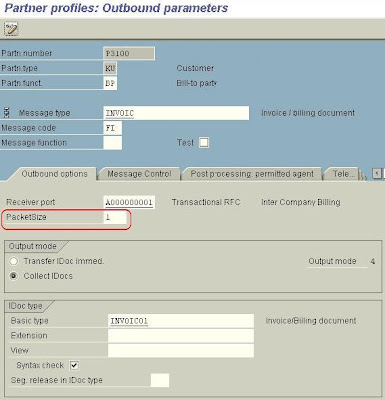

Enter the following data in the appropriate fields:

Partn.funct. BP

Message type INVOIC

Message Code FI

Receiving port A000000001

Basic Type INVOIC01

Press enter and the screen will change to the following:

Enter PacketSize 1

![]()

Go to the Message Control tab press

![]()

and enter the data as specified in the following

screen.

You can repeat the process for cases where invoice verification is done against purchase

order. in this case enter MM in “message code field.

![]()

As you can see the only difference between the FI & MM invoice is in the message code

and output type.

NOTE: You cannot use output type RD04 again therefore you must copy it in

customizing to another output type (in this case RD00)

VendorFollow the same procedures but maintain the inbound parameter Screen as follows:

![]()

7. FI CUSTOMIZINGFinancial Accounting à Accounts Receivable and Accounts Payable à Business

Transactions -> Incoming Invoices/Credit Memos -> EDI -> Enter Program Parameters

for EDI Incoming Invoice (T. Code OBCE)

![]()

Make sure to maintain posting types, tax code and invoice doc.type.

Use KR when not using purchase order & RE when using purchase order.

![]()

Assign Company Code for EDI Incoming Invoice

![]()

By leaving the field CoCD blank, all company codes are available.

Assign G/L Accounts for EDI Procedures (T. Code OBCB)

P1180 = Vendor

3100 = Company Code of receiving company (of customer)

![]()

NOTE:

G/L account should not be connected to CO. Assign Tax Codes for EDI Procedures (T.Code OBCD) It is necessary to match the output tax from the sales order to the input tax.

Tax type = Output Tax

Tx = Input Tax

![]()

Accounting -> Financial Accounting -> General Ledger -> Master Records -> Individual

Processing -> Centrally (T.Code FS00)

![]()

G/L account no. = account number that was entered in transaction OBCB (page 24)

Tax category must allow for input tax.

Make sure manual posting is allowed for the G/L account. (“Create/Bank/Interest”

screen).

TEXT

In many cases the G/L account has been configured so that text is mandatory. This could

be either Header Text or Item Text.

Header Text

No special configuration is necessary. Just enter text in the “Header note”. You may use

the following access sequence.

Item Text

It is necessary to implement a userexit in order to fill the item text field. Detailed

instructions are found in note 39503

8. MM Customizing:Make sure the Unit of Measure’s ISO Codes are configured correctly.

General Settings à Check units of measurement (T. Code CUNI)

![]()

Optional MM Customizing:NOTE: This is only necessary for logistics invoice verification.

Materials Management à Logistics Invoice Verification à EDI à Enter Program

Parameters

![]()

Monitoring

There are several transaction that allow you to monitor the IDoc. First you need to know

the IDoc number. You can see the IDoc number in the processing log in the “Header

output” screen in the billing document.

You can use transaction WE02 or WE05. Enter the IDoc number in the selection screen. If you have an error in the IDoc, you could analyze it with transaction WE19